Investing in the stock market is like an art, and stock market investors are no less than artists. The better you perform this art of investing in the stock market, the better you get rewarded for it. Depending upon your style, risk and other factors there are different types of investors in stock market.

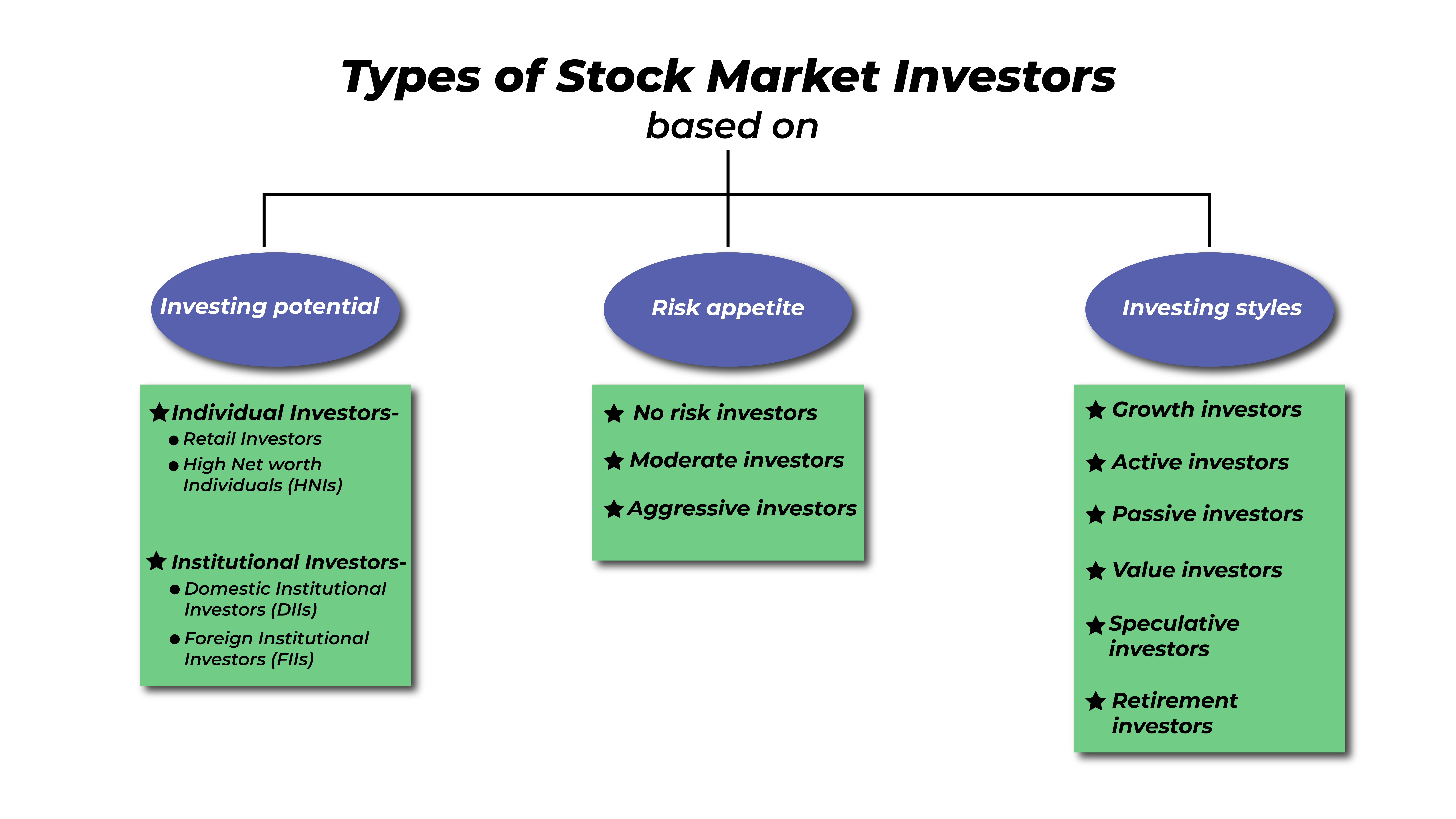

To extend a democratic and uniform approach in the stock market, all the investors are distinguished on the basis of their investing capital, risk appetite, investing styles or opinions.

Nowadays, the majority of people are willing to participate in the stock market with one common objective i.e. earning, which directly contributes to the capital generation of the country.

If you desire to enter or are new in the world of the stock market, understand the different types of investors in the stock market to identify the way you would want to invest in the stock market.

Types of Stock Market Investors in India

As discussed above, the investors in the stock market enter into the investing space with different ideas, goals, and capital and thus they vary from each other. For a better and deeper understanding of the types of stock market investors, we have arranged them in the following categories –

- Types of investors based on investing potential.

- Types of investors based on risk appetite.

- Types of investors based on their investing styles.

Let’s consider each of these categories, one by one and gain an understanding of meaning, investment style and other objectives in detail.

Let’s consider each of these categories, one by one and gain an understanding of meaning, investment style and other objectives in detail.

On the Basis of Investing Potential

The Indian stock market is full of diversity. There are several types of investors that contribute to the stock market.

Let’s take a closer look at the types of stock market investors distinguished on the basis of their investment potential.

1. Individual Investors

Individual investors are those investors that are non-professional, non-institutional. They buy and sell securities for their own account with personal interests.

There are two types of individual investors, – Retail Investors and; High Networth Individuals.

-

Retail investors

Understanding the retail investors meaning, this class of investors includes individual investors who get the right to buy and sell shares of a particular company worth Rs 2 lakh in the share market. They tend to execute their trades in a non-professional way since they are trading on their personal account on their own.

Retail investors enter the stock market with the most fundamental objective, that is income generation. The purpose of which may vary from investor to investor.

Since they are non-institutional individuals, they have to research, analyze and implement on their own without any guidance and expert insights. Retail investors have a low-risk appetite and financial power.

Therefore, most of the time they trade in comparatively lower volume. As per the SEBI law, retail individuals are those who apply for securities less than the value of ₹2,00,000.

Retail investors have been in the limelight of SEBI for the last few years.

Therefore, SEBI focuses on promoting and protecting retail investors, which has led to a significant increase in the number of retail individuals in the stock market over a few years.

-

High Net Worth Individuals (HNIs)

Also known as Non-Institutional Individuals (NIIs), High net worth individuals are categorized on the basis of net worth and investible assets.

In India, those individual investors with an investing surplus exceeding Rs 5 crores are considered as HNIs. The total net worth of HNIs in India adds 1.3 Trillion Dollars i.e. 58% to the total Indian GDP.

There were around 2,70,000 HNIs in India by 2017, later on the number of total HNIs in India crossed 330,000 as of 2020 and it is predicted by the experts that by 2027 the number of HNIs in India would cross 9,50,000.

Another fact about High Networth Individual investors is that their risk appetite is significantly high.

Along with that, the trading activities of HNIs are tracked with the purpose to predict the stocks price because their activities highly influence the demand and supply as well as the performance of the stock.

2. Institutional Investors

Institutional investors are those organizations and companies that invest in securities and schemes on the behalf of other people. These are professional investors with the utmost knowledge and expertise of investing in the stock market.

Here are some of the different types of institutional investors –

- Domestic Institutional Investors (DIIs)

Among the various types of stock market investors, Domestic institutional investors are the domestic companies or organizations that accumulate money from small investors and invest it in the securities and other financial assets of the same country they are based on.

DIIs make their investment decisions on the basis of current domestic economic trends and political scenarios.

Domestic institutional investors make a crucial impact on the net investment flow into the economy of the country.

A report from the Securities and Exchange Board of India (SEBI) provided a disclosure that DIIs like mutual funds hold around 9% of the total securities traded on BSE.

‘Domestic Institutional Investors (DII)’ is an umbrella term that comprises the following investors –

-

- Indian Insurance Companies – Indian insurance companies are one of the major contributors to the stock market among domestic institutional investors. These companies pool money in the form of premiums paid by the customers in return for insurance services. Insurance companies operate by investing the pooled money into income generating schemes and assets.

-

- Financial institutions and banks – Banks and other financial institutions also contribute to the domestic institutional investments of India. The primary source of income of such financial institutions is the interest received on the loans that they grant.However, some banks prefer to invest some percentage of the total deposits from the public in the stock market.

-

- Indian Mutual Funds – Indian AMC mutual funds are the biggest DIIs that contribute to the stock market. Mutual funds invest the funds that are pooled from the small investors into a wide range of securities. AMCs collect the money from various investors (especially retail investors) and invest it in numerous income generating schemes. The investing decisions, analysis, and strategies are made and developed by professional investors. These institutional investors operate professionally and invest in the stock market on the behalf of other investors.

-

- Domestic pension funds – Pension funds are meant to create a retirement corpus for individuals as financial assistance post their retirement. These local pension funds also invest the money pooled from people as installments of their pension scheme in the stock market.

- Foreign institutional investors (FIIs)

Foreign institutional investors (FIIs) execute trades in a country but are entrenched outside of the political boundaries of that country. In simple words, FIIs are those institutional investors that invest in foreign countries.

Since 1991, when the FIIs were allowed to participate in the Indian stock markets, they have been the primary source of the international fund for the Indian economy.

In addition to that, Foreign institutional investors (FIIs) have aided potential small businesses by providing the necessary guidance and required funds.

FIIs are consistently rising in India, therefore they have gained an essential role in the stock market to act as market movers. The investing activities of FIIs make a substantial influence on the market performance and investor sentiment. Moreover, it helps in predicting the performance of the market in the long run.

Foreign Institutional Investors include sovereign wealth funds (government-owned investment funds), hedge funds, mutual funds, pension funds, investment banks and insurance companies.

On the Basis of Risk Appetite

Investors need to consider plenty of crucial factors before investing their own money or pooled money. One of which is the amount of risk they are willing to go for termed as risk appetite. Each investor carries a different risk potential while entering or investing in the stock market.

The risk appetite of almost all the investors keeps changing according to the economic trends, political scenarios, financial plans, and objectives, experience, investing surplus, and age factor.

The amount of risk an investor is capable of bearing determines his approach and investing style as well as works as a parameter for developing strategies.

Know more about types of investors in the stock market on the basis of their risk appetite and find out which one you are –

1. No Risk investors

No-risk investors are conservative investors. These are the investors whose primary focus is on short-term goals, therefore they do not commit their capital to long-term investments.

Conservative investors aim at securing their capital, hence, they would rather invest in low return schemes than take risks in the expectation of earning huge returns.

No-risk investors are generally retail individuals.

Some of the best recommendations for no-risk investors are – Fixed deposits, provident funds, and SIP investments in mutual funds.

2. Moderate Risk Investors

Among the various types of stock market investors, moderate investors are the investors with a moderate risk appetite. Such investors generally use diversification to make their portfolio better as well as to protect their profits and prevent loss during bearish trends.

A moderate investor expects to earn stable but moderate returns on his investments. Therefore, the investors select the stocks that are risky up to some extent but also offer good returns.

3. Aggressive Investors

Aggressive investors generally have enough expertise and knowledge. Therefore, they believe in taking huge risks in order to earn huge returns. The majority of aggressive investors have large portfolios. 80% of their portfolio consists of equity.

Furthermore, they prefer to stay invested for the long run to grow along with the quality stocks and benefit from the power of compounding. Some of the High net worth individuals (HNIs) follow an aggressive approach to investing.

On the Basis of Investing Style

The investing style also plays an important role in determining how an investor’s investing journey will turn up. Stock market investors base their investing style on different factors. Such as objective, financial backup, age factor, employment, lifestyle, and mindset.

Here are some of the common types of stock market investors based on their different investing styles –

1. Growth Investors

Investors prioritize buying those stocks that have a huge potential to grow in the near future.

These investors analyze the growth potential of the company and plan their investments accordingly. Some of the reasons for high growth potential can be the latest strategies, new projects, and launch of a new product, etc.

Growth investors generally invest their money in small-cap stocks, IT companies, and healthcare companies.

2. Active investors

Active investors are those investors who actively participate in the stock market. They keep track of various stocks, and current market trends, and keep up with the news.

Active investors focus on research and analysis of the market performance and trends and trade accordingly. They make each investment decision with utmost planning and study. Similar to growth investors, active investors also do not stay invested for the long run.

3. Passive investors

These are the type of stock market investors who tend to spend less time and attention while investing. Passive investors do not crave huge gains, rather they prioritize taking less stress and accept reasonable gains.

They prefer investing in mutual funds to get rid of the process of analyzing and decision-making in order to save time.

4. Value investors

These investors are generally long-term investors, who invest their money in the stocks that are being traded at a price below their actual or book value.

Value investors analyze the market and keep a track of the companies that are fundamentally strong but whose stock price is less than the potential price.

They make profits by holding the undervalued stocks for the long term or until they grow up to or more than their potential.

5. Speculative investors

Speculative investors are the investors who often invest like growth investors but one major difference is the amount of risk involved. These investors generally have a high-risk appetite and invest their surplus with an aggressive risk approach. Speculative investors are also known as speculators.

These types of investors desire to rapidly earn returns on their investment, therefore keep looking for a special profitable opportunity in the market.

Speculative investors dig up the news to find an opportunity to earn high returns in a short period.

These investors usually invest in such companies where corporate actions including mergers, acquisitions, changes of management, and takeovers are occurring.

6. Retirement investors

Retirement investors include those investors who are investing with the objective of earning for leading a hassle-free retirement.

These investors usually have a low-risk appetite. Regardless of how they used to trade in their mid-age, retirement investors prefer investing in low-risk stocks and schemes.

Conclusion

Above is the list of types of investors categorized on the basis of different parameters. Check the category you fall in. Also, you can gain an understanding of the investment behavior of other investors in the share market.

To lay a strong foundation and kick off a better start to your investment journey, join the stock market course now.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: