The whole weight of earning profits from Trades rests on the intraday strategy employed by an investor. Beginners might not be aware of what an Intraday Trading Strategy might look like, let alone its importance to the cause of making profits.

Fact – Intraday trading is the most populated of all trading segments. It is also the most popular trading segment for investors who have little to no experience of trading or knowledge about the stock market.

Intraday Traders make money on their investments by taking advantage of the volatility of the stock market. Intraday traders constantly stay on the lookout for an investment opportunity that arises due to the ever-fluctuating stock prices.

Having an intraday trading investment is crucial for an investor to make the most of when an opportunity arrives, i.e. stock prices fluctuate.

An intraday trader would be required to be capable of reading, interpreting, and reviewing the stock market charts, graphs, bars, etc. For this, the right knowledge of the intraday trading time for different trade segments is of utmost importance.

Interpreting the charts is a part of the “Technical Analysis of Stocks” which is considered to be complex and more advanced topics of the stock market.

So, ideally, a novice should look to learn technical analysis before looking at any intraday trading strategy. Without the ability to make sense of the charts, a trader would hardly be able to intraday trade.

You may also choose to read some of the most prominent books for technical analysis for your reference.

While you get to learn stock market from these books, in this particular article, we detail out the different intraday trading strategies you can use.

Intraday Trading Strategies in India

The intraday trading segment offers its participants enough opportunity to make profits. One of the chief characteristics of an intraday trader is having an eye for detecting one which is done through keeping track of the stock trends.

This pretty much sums up what all is required to excel in intraday trading – dedication, a fair amount of understanding of the stock market, and most importantly patience. Intraday trading requires investors to play the waiting game.

Here is a quick review of how intraday trading works?

An investor might settle for any intraday trading strategy, but will no matter require a lot of patience to effectively implement it. Novices might require some extra time to develop the skill though.

Another point that needs to be clarified here is that no intraday strategy is foolproof as its performance is dependent on the stock market conditions for the day. A strategy might suit investors on a given day but might completely fail him on others.

Here are some of the most often employed Intraday Trading Strategies:

Reversal Intraday Trading

Reversal Trading is also known as “Mean Reversion Trading”, and “Pullback Trading”. This strategy involves betting on stock against their price trends, hoping them to make a “Reversal”.

When a stock makes a “Reversal”, it means the direction of a certain stock’s price trends has changed. A stock that was once surging upwards suddenly begins to dip or a stock’s prices suddenly begin to rise.

Through this strategy, a trader can enter the market at a support level. Every trader would without a doubt love to find a position near the support level. Staying closer to the support level ultimately will help in making higher profits.

A “Support Level” is a low point in a stock’s price trends. The stock doesn’t drop below this point which prompts buyers to get in the mood to purchase the stock.

When it comes to select stocks for intraday traders should look at stocks at extreme ends of the market, i.e. stocks peaking at new highs and new lows. As soon as the trader recognizes the stock’s reversal, he/she takes a long position to make profits on the stock’s rise.

In case, if the stock sees a decline the trader will have to close his short position so as to prevent from taking losses.

Also Read: Intraday Trading Tips

Momentum Trading Strategy

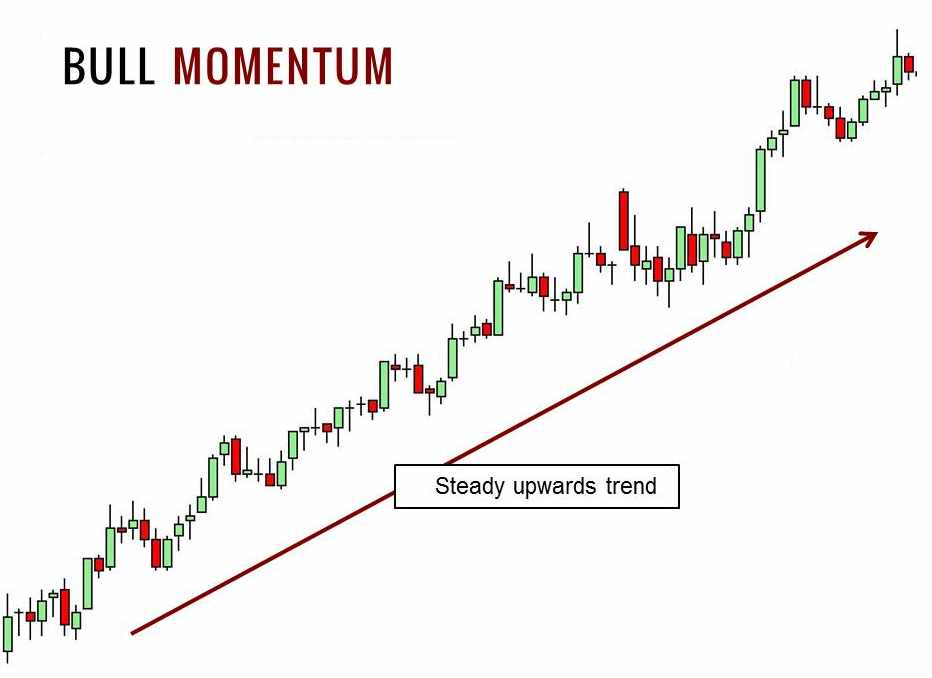

The Momentum Trading strategy is when an investor purchases a stock after detecting its rise and sells the same when it appears to have attained its peak. Momentum trading, therefore, involves an investor keeping track of an up-trending stock’s movement.

There are stocks on the market that make big price movements (around 20% – 30%) every day.

Momentum Trading requires a trader to act quickly in making the investment as soon he/she identifies a big moving stock, holds a position on the stock, and makes the right exit.

Investors take help from intraday technical indicators, usually volume indicators in identifying an upward moving stock for implementing the momentum trading strategy.

With just the right move, an investor can make huge profits in under a blink of an eye.

Scalping Trading Strategy

The Scalping strategy is hugely popular among currency traders. The whole idea of Scalping Trading Strategy is to make multiple profits throughout the day.

The traders who implement this strategy, known as scalpers, look to take advantage of price movements – no matter how small and make small profits that add up to make an overall bigger profit towards the end of the day.

Scalpers instead of focusing on winning big on a few stocks, look to win small on multiple stocks.

Note that the intraday scalping strategy is relatively hard to master as it requires an investor to keep tabs on a number of stocks and study their trend.

Note that the intraday scalping strategy is relatively hard to master as it requires an investor to keep tabs on a number of stocks and study their trend.

The process of Scalping strategy forex requires scalpers to pick multiple stocks, hold positions for a short period of time, and have an exit strategy to make profits. The scalper trades multiple times a day and requires the ability to find a winning stock on a regular basis.

This strategy will work fine with traders who don’t want to get exposed to the big risks of intraday trading for longer periods.

Breakout Trading Strategy

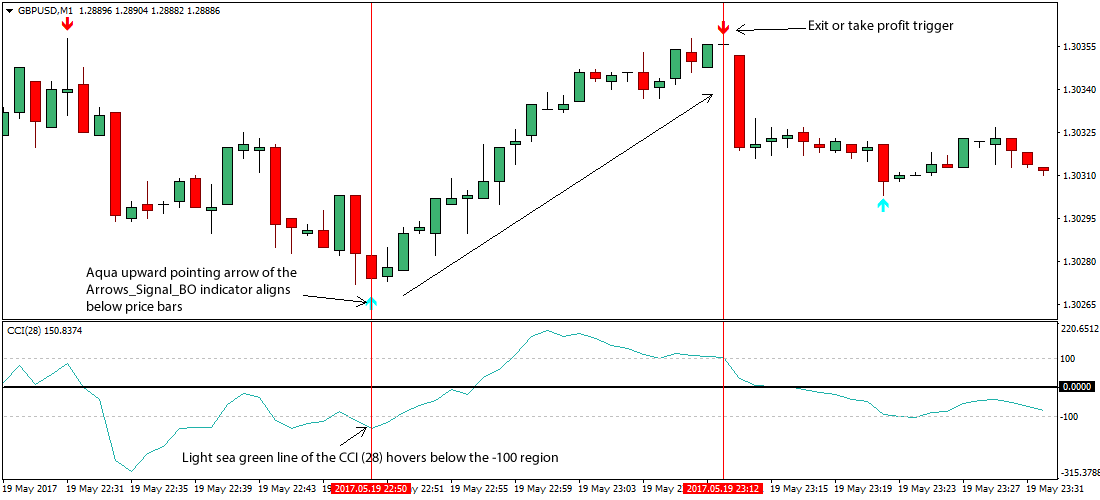

A Breakout Trading Strategy involves a trader entering the market after the stock prices have exceeded past the limits on either extreme ends, which is the support level and resistance level.

Anytime the stock prices move past the support and resistance levels, it indicates market volatility.

Usually, the price trend follows the direction of the breakout. Prices come down if breakouts occur near the support level and rise in the case the breakouts show up near the resistance level.

Investors detect these breakouts with the help of technical indicators. However, the Volume Weighted Moving Average is by far the most commonly used Breakout Trading indicator.

Investors detect these breakouts with the help of technical indicators. However, the Volume Weighted Moving Average is by far the most commonly used Breakout Trading indicator.

The ideal Intraday Breakout Trading Strategy for an investor would be to take a long or bullish position on stocks closing above the resistance level.

Similarly, if the stock prices are about to close below support levels, then the investor should take a bearish position.

One such indicator is the Bollinger bands, now it helps you to make a trade decision at the same time it is the best indicator with RSI that can be used to generate confirmed signals.

Pullback Trading Strategy

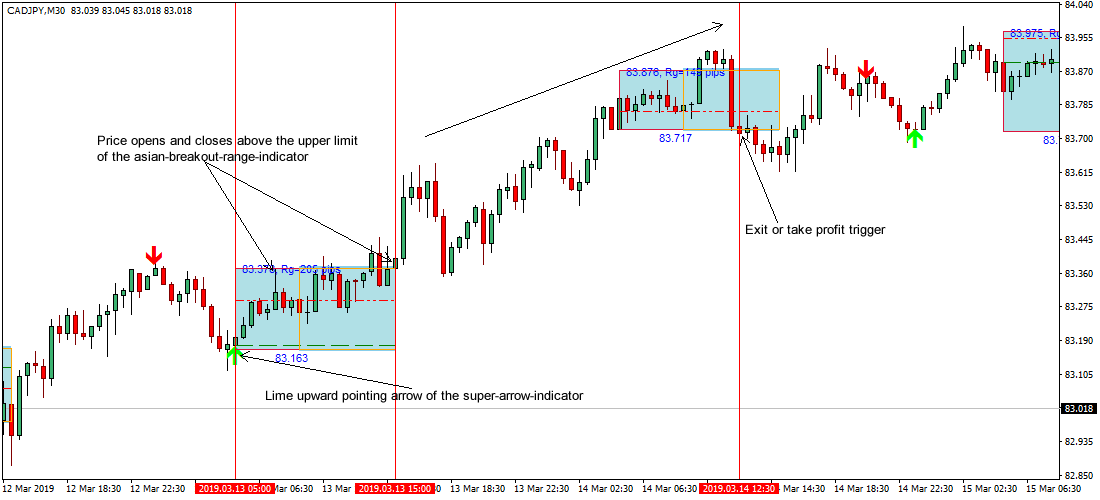

The term Pullback refers to the phenomenon of the prices of a financial instrument moving in the opposite direction for a brief period.

Usually, these pullbacks cause a lot of confusion for many investors who have a tough time identifying a Pullback from a breakout.

Pullbacks are also known as Retracement or Price Corrections. Having an Intraday pullback strategy benefits the investor as it allows them a better reward to risk ratio.

Investors include the Fibonacci Indicator in their pullback trading strategy to ascertain a stock’s position whether it is near the support level or resistance level.

Investors include the Fibonacci Indicator in their pullback trading strategy to ascertain a stock’s position whether it is near the support level or resistance level.

An ideal Pullback trading strategy rests on the assumption that the stocks on an upward trajectory that changed their direction towards the support level will eventually rise. This opens up an investment opportunity for traders who want to sell their stocks.

On the other hand, a well-performing stock will eventually have a pullback and thus it is a favorable time to buy the stocks.

Gap and Go Trading Strategy

Gaps are empty spaces that show up on a stock market chart due to a lack of trading activity. Gaps occur between two consecutive price bars. These gaps are a regularly occurring phenomenon and are caused by some major occurring or announcements.

An intraday trader should look for gaps of more than 4% as these allow better trading opportunities as shorter gaps are likely to be filled quickly. Usually, these gaps show up during the first hour of the trade.

The first step of the process for Intraday traders who opt for this strategy is to look for these gaps.

The first step of the process for Intraday traders who opt for this strategy is to look for these gaps.

The traders also known as Gappers take up positions after closely observing the trend. If the stock price begins to rise, the investor should take up a long position.

In case, the market gaps down, an investor’s best bet would be to take a short position.

Conclusion

Intraday trading is no doubt a rewarding prospect. However, with all the benefits and perks comes its own share of risks. Many enter the intraday trading segment mistaking it to be less risky than other stock market trading options.

Intraday trading is also hugely populous, to begin with, and such extreme is the volatile nature of the stock market that a single wrong move can completely wipe an investor’s money.

Traders need to make their way around this volatile nature of Intraday trading. Intraday traders tend to do so by resorting to using the various intraday trading strategies at their disposal.

The investor will need to learn these strategies and the right conditions, circumstances to implement them. Another thing that needs to be brought to the notice is that the strategies might work efficiently on a given day, yet may not bring the desired result on others.

Investors who would like to learn more about the various intraday trading strategies can enroll for Intraday courses on the stock market learning app, Stock Pathshala. You can find all kinds of stock market courses in this app.

The e-learning platform houses intraday trading courses which will help novice investors and traders in their endeavors.

Well, with all being said investors need to be patient as the ability to efficiently execute the strategies only comes with time and experience.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: