Numerous factors, including time decay in options, open interest, etc., play a major role in analyzing trends, the aggressiveness of traders, and the premium value in options. Along with many other factors, IV in the option chain plays an important role in determining the potential risk and reward in options trading.

But what exactly is IV and what role it plays in analyzing options?

In this article, we will be discussing the meaning, role, and importance of implied volatility in options trading.

What is IV in Option Chain?

IV stands for Implied Volatility. So let’s discuss the meaning of volatility before understanding IV meaning in the option chain.

Volatility is the rate at which your share price rises or falls. So 3% volatility means that the price of the stock can move up and down by 3% of its current value. Generally, this is the concept of historical volatility that is determined using the historical movement and tells a trader about the current market situation.

When it comes to implied volatility, it helps in determining the future volatility of the stock or index. Since future and options trading involves trade settlement at the pre-determined price in the future, hence IV plays a vital role in F&O trades.

So if Nifty is trading at 18000 and the ATM strike price has an IV of 10%, this means that the index value can move in the range of 16800-19200 annually. This helps in determining the range.

Now the question here is, how this information is helpful for options traders as options generally come with weekly or monthly expiry?

If the implied volatility increases, the premium of your option will also rise, irrespective of the option’s type (call or put). The reason behind this is that a seller decides the premium thinking that it will expire in out-of-the-money and if volatility rises, this means the price movements could be high and have more chances to expire in-the-money increasing risk and hence the premium value of options.

To calculate the change in premium with respect to IV can be determined with the help of Option Greek, Vega.

How to Read IV in Option Chain?

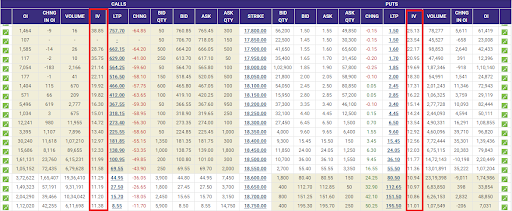

There are multiple strike prices in options and the strike price with the value near the current market price is the ATM option. As shown in the image below, each strike price has a different IV value. Getting into the deeper analysis, it is clear that IV of the ATM option is the lowest, and its value increases for the ITM and OTM options.

This clears that the possibility of the index value moving in either direction from its ATM value is comparatively less than ITM and OTM options.

Let’s suppose the premium value for the ATM call option is ₹100 and the IV is 10%. Now if the IV value changes to 12% how much the premium value will change?

Here as already discussed when IV changes, one can determine the change in the premium value using the Option Greek Vega. Let’s understand it in detail to calculate the impact of change in IV value on option premium.

Vega in Options

It is the options Greek that measures the sensitivity of implied volatility on the option premium. It helps in determining the value of the premium with a 1% change in implied volatility.

For example, if the vega is 10 for the ATM option. Now as considered in the above example, where implied volatility changes from 10% to 12%, the premium value will change by ₹20.

Since IV increases, hence the option premium value will increase to ₹120.

In another case if implied volatility decreases by 2% the option premium value declines by ₹20. This calculation is the same for both call and put options.

Now unlike implied volatility which is lowest for ATM options, Vega is maximum for ATM and decreases as the option moves deep ITM or OTM.

The effect of change in volatility is highest for the options which have far expiry, this means vega is higher for far expiry in comparison to near expiry. Thus buying options for far expiry could be expensive and this is why option buyers lose money as compared to option sellers who generally write options of far expiry and earn high premium value.

How Does IV Changes in Option?

There are many parameters that change the implied volatility value in the option chain. Some of these factors are:

- Economic conditions like GDP changes, interest rates, etc. can change market volatility.

- Political events, elections, and geopolitical meetings can affect volatility as well.

- Sector News also increases implied volatility. For example, recently, people have believed that the future is in AI. So investors are making tech shares highly volatile.

- Market manipulation, such as insider trading and additional illegal methods, can change the market overnight.

- Huge changes in the supply and demand of a specific asset can also make the market volatile.

Option buyers holding positions in such conditions are gained by an increase in premium value, however, sellers with open positions lose money with an increase in IV. The increase in IV also changes the value of the options trading margin, thus the seller needs to check the exposure margin at the regular interval.

Also, with the increase in IV, the risk of sellers increases and hence the new buyers get the option at high prices.

Importance of IV in Option Chain

To earn profit in options trading, it is important to understand the concept of implied volatility and its importance in options. Here is the role of IV in options trading:

- IV can help you figure out the uncertainty and sentiment of the market.

- Option buyers can use it to set premiums.

- You can use it to make your trading strategy more effective.

Disadvantages of IV in Option Chain

Along with the advantages, here are some of the disadvantages of IV data in option trading:

- It is completely based on the asset price and not on any other fundamentals.

- Implied volatility can change with news or major global events.

- It surely predicts that the price will move but does not tell the direction, for that, you will have to analyze other factors as well.

Conclusion

IV in the option chain can be used to make better trading decisions, but you should keep in mind that nothing is 100% guaranteed in the stock market world. Similarly, IV can inform you that the market may go volatile but doesn’t guarantee anything.

If you want to know what option chains indicate and how to get the most out of them, you can enroll in our stock market courses. We deliver stock market knowledge in the simplest ways.

In case you’d like us to call you back to explain more about stock market learning, just leave your contact info below:

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: