Profit in options trading is often ignored by the traders because of the complexities involved in the segment. There is no doubt that options trading can be a little intimidating not just for beginners, but also for experienced individuals.

But with the high risk involved the options trading, high rewards also come in handy. So, is there no way to gain profits while guarding oneself against losses?

There certainly are several ways to always be in the profitable business of options trading. But before understanding the strategies, let us have a look at what is profit in options trading.

Option Trading Profit

The options trading comprises of call option and put option. Choosing one depends totally on the market sentiments and the trader and the idea of making a profit. This is further divided into two segments: option buying and option selling.

If you are aware of how to do option trading then you might have an idea that option trading involves a contract between a buyer and seller with a price and a fixed date. The one who pays the non-refundable amount or premium is the one who has the right and not the obligation to either execute the order or leave.

So, an option buyer is the one who executes the trade at Last Traded Price i.e. LTP in options (in both call and put cases). Therefore, he/she has the right but not the obligation to execute the order, when the market is moving in favor and leave the contract in case the situation is not favorable. In this case, the profit is unlimited, while the loss is capped at a premium.

Contrary to this, an option writer is the one that receives the premium, thus focusing on earning money via the premium. He does not have the right to leave the contract, even when the market is moving against his sentiments. In this case, the profit is limited to the premium but the loss can be unlimited.

So, if you have low capital and want to start option trading with 1000 rupees then, you can begin your journey as an option buyer where you can choose the strike price with the low premium value.

Even though buyers can make an unlimited profit but 82% of options traders who lose money in the market maximum are buyers. Wondering why option buyers lose money even after having the right to trade.

Well, this is because of the depreciating time value which works in the favor of the option writer. Moving forward, let’s now get into the detail of how profit is calculated in options.

How is Profit Calculated in Options?

Who doesn’t like the idea of making profits? Options trading is a very fascinating segment if you learn derivatives and then start with the segment. Often people start options trading without any prior knowledge and therefore end up not making a profit in options trading.

But how will you calculate the profit in different situations of options trading?

There are two segments in options trading: call option and put option. The difference between call option and put option is the former gives the buyer the right to buy and the latter to sell in the bullish and bearish market, respectively.

To take a trade position and to determine the profit you can use different strategies and an understanding of what does option chain indicate.

To understand the basics let us first elaborate on the profit-making situation in various conditions of options trading.

-

Buying a Call Option

When individuals have bullish sentiments about an underlying asset, they usually go long on the call option. Now in options trading, whenever you are buying an option, you have to pay a premium. So, the entire cost that you spare is the premium. Since you are the one paying the premium, you have the right and not the obligation to execute the contract.

Here the profit on the expiry day is equal to the intrinsic value of options which is the difference between the Spot Price and Strike Price.

Now, let us assume the profit and loss situation with an example. Suppose you buy a call at a strike price of 15,800, with a premium of ₹220. Then there can be different conditions in the same.

- The price reaches ₹16,500: In this case, the market price has moved according to the buyer’s sentiments thus the call option buyer will execute this order. The profit, in this case, will be as follows.

Strike price = 15,800

Spot Price = 16,500

Premium Paid = 220

Intrinsic Value= 16500 – 15800

=700

Net Profit/loss =700 – 220 = 480 - The price stays at 15,800: In this case, it is obvious that the call option buyer will not execute the order. This is because he has already paid a premium of ₹220 for the same strike price, so the price at least has to move beyond 16,020 to give him a profit. Therefore, if such a situation arises, the call option buyer will bear the loss of ₹220 and will not execute the order.

- The price moves to 15,500: If the market moves downwards, then it is obviously against the sentiments of the call buyer, therefore in such a case as well, he/she will not execute the order and will bear the loss of premium.

So, it is obvious that in the case of buying a call option, the breakeven point is strike price+premium paid. And it is only after the market crosses this price, that the buyer starts making a profit.

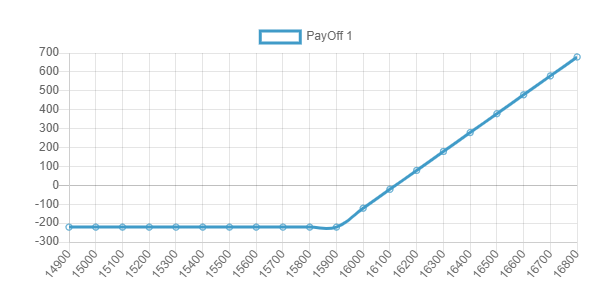

The loss of buying a call option is capped at the premium paid, and on the other hand, the profit can be unlimited. You can also look at the given graph to understand the options trading profit more clearly.

Till the price point of ₹15,900, the graph forms a straight line as there is no profit in that zone. It is only after the breakeven point, that the profit of the same starts rising and reaches a good zone from ₹16,200.

This gain or loss of the buyer or seller helps in determining the option turnover value which eventually is helpful in calculating taxable profit and in evaluating overall option trading activity.

-

Selling a Call Option

You can also write a call option or in short sell it. In this case, rather than giving the premium, you will be the one receiving the premium. In this case, you will have to sell the asset to the buyer at a decided price, no matter where the market moves.

The call option writer does not choose to leave the contract before the expiry and is bound to execute if the buyer decides to.

Let us understand it with the same example as used above. Suppose you sell a call option at a strike price of ₹15,800 and you receive a premium of ₹290.

- The price increases to ₹16,200 If the price moves in a bullish trend, it is likely for the buyer. In this case, he will execute the order and the writer will be obligated to sell it at a price of 15,800. The loss in this situation will be.

Strike price= ₹15,800Spot price – 16,200Premium Received- ₹290

Profit/loss- 16,200-15,800 = 400

290-400 = -110 - The price stays at ₹15,800 When the strike price does not move, the call option buyer will not execute the order, and thus the call option writer will make a profit of ₹290 (the premium received)

- The price goes down to ₹15,600 It is obvious that in this case, the market is moving against the bullish sentiments of the buyer, so in this case, as well, the writer will make a profit from the premium received.

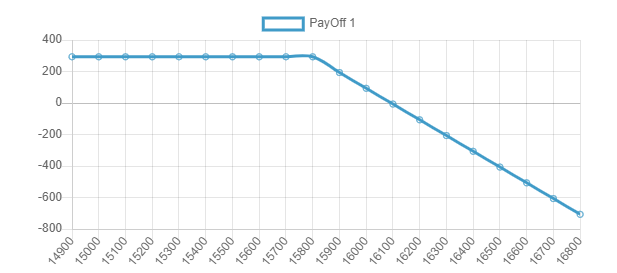

We can therefore say that the profit in the case of call option writing is limited to the premium, whereas the losses can be unlimited.

As visible in the graph, the call option seller will make a profit till the time the market is at or below the strike price. Once it reaches the breakeven point, the profit starts minimizing, eventually leading to losses. To earn more profit in options, consider IV in option chain which increases the premium value and brings an opportunity to pocket more premium.

This is how a call option works in both cases. Now let us move towards the put option.

-

Buying a Put Option

When an individual has bearish market sentiments, i.e he believes that in the future the prices will go down the trade in a put option.

A put option buyer is the one that buys the right and is not obligated to sell the contract. This means that even if the prices of the market move down, he has the right to sell the asset at a higher or a pre-decided price. In a sense, a put option buyer is actually the seller.

Let us understand the profit and loss with the help of an example. Suppose you bought a put option at a strike price of 15,800 and pay a premium of ₹210. Now let us look at the details in various market conditions.

- If the stock prices move to ₹15,200 Now the buyer placed a bet at the strike price of 15,800 believing that when the market will move downwards, he will still have the right to sell it at the same price. Now, if the spot price reaches 15,200, this means that the market has moved in favor of the put buyer. The profit, in this case, will be calculated as given below. Strike Price- 15,800Spot Price – 15,200Premium paid – 210Profit – 15,800 – (15,200+210) = 390

- If the stock price stays at 15,800 In this case, there will be no benefit for the put option buyer because there is no difference in the price and he has already paid the premium. In this case, he/she will not execute the order and will leave the contract bearing the loss of only the premium.

- If the stock price moves to 16,300 In this case, as well, the put option buyer will make no profits as the market is moving against his sentiments. But he does not have the obligation to sell the contract, therefore, he can leave the contract without executing and bear the loss of the premium.

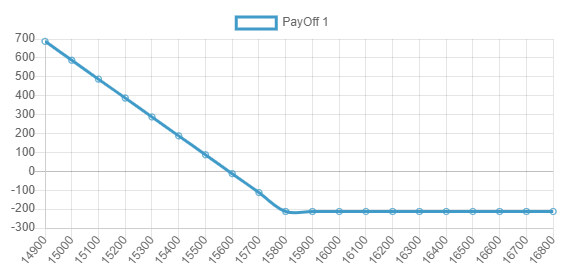

By looking at the graph, we can generalize the profit and loss of the put option buyer as follows.

-The loss of the put option buyer is limited to the premium that he pays.

-There is an unlimited scope of profit if the spot price stays below the strike price.

-The situations of losses are when the spot price is similar to strike price or more than that.

– Strike price + premium paid is the breakeven point for the put option buyer.

-

Selling a Put Option

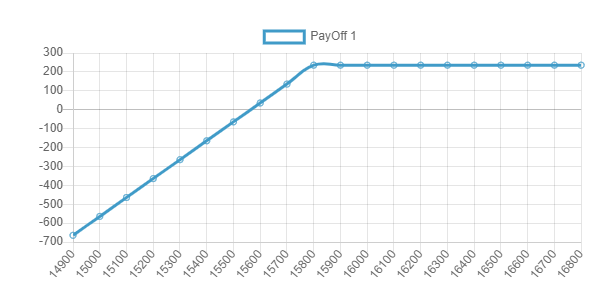

A put option seller is the one who receives the premium and is obligated to purchase the assets at the pre-determined price no matter in which direction the market moves. A put option seller cannot choose to leave the contract without executing it.

Let us understand this with the same example. For example, you write a put option contract at 15,800 and receive a premium of ₹230.

- When the market moves to 15,200

The condition is favorable for the put option buyer and therefore he will execute the order. The writer, in this case, will be obligated to buy at the higher (pre-determined) price, i.e 15,800. Spot price- 15,200

Strike price- 15,800Premium received- 230Loss- -370 - If the stock price stays at 15,800 Most probably, in this case, the put option buyer will not execute the order. Therefore, the writer will make a profit from the premium

- If the stock price moves to 16,300 The market is moving against the sentiments of the buyer hence he will not execute the order and therefore in this case as well, the put option writer will make a profit from the premium..

- To sum up the concept of how option selling works, we can say that the profit is in the cases when the spot price is at or above the strike price.

Conclusion

People often consider option trading a tough nut to crack. But if you learn stock market properly, especially the derivatives segment, you can make good profits. You can take the help of various educational sources like the best books for derivatives trading and add your practical approach to be the best in the arena. You can easily calculate your profits before making any trading decisions as well.

If you want to learn more concepts related to the stock market, you can take up the stock market course and become a professional.

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: