The huge profit in options has attracted most of the traders in the last few years. Looking at the SEBI current report, the number of active traders in the F&O segment has increased by 88% in 2022 as compared to 2019. But do you know that around 82% of those traders are losing money and most of them are option buyers? So, why option buyers lose money?

In this article, we will cover all the aspects that lead to losses in option buying and ways to reduce the loss.

Maximum Loss in Option Buying

Now before getting into the details of losses in option buying, let’s understand its meaning.

Option buying is to pay the amount called premium to buy a contract that gives the right but not the obligation to execute the trade at the pre-determined price in the future date called expiry.

In the call option, the buyer pays a premium when he is bullish and expects an increase in the price or value of the underlying asset. On the other hand, the put option buyer, he bearish toward the market.

Now, if the market moves in the expected direction then the buyer earns profit, however, if goes south then the buyer holds the right not to execute the trade and exit the market with the loss of the premium amount.

In simple terms, the maximum loss of option buyers is equal to the premium.

Reasons for Option Buyers Lose Money

An option buyer can make an unlimited profit, and everyone thinks that it is easier to earn profit in options trading, however, generating profit from option buying is not a cup of tea. You need to understand the risks and acknowledge them.

Now to understand the risk of losing money, it is important to know how to determine the premium value.

In general, two different values help in determining the premium value, intrinsic value, and extrinsic value.

On one hand, where intrinsic value is the difference between spot and strike price and depends on many parameters, extrinsic value or time value declines with each passing day.

So, let’s say you bought Nifty 18000 CE for ₹100 when the market is trading at 18070, then:

Intrinsic value= 18070-18000

=70

Premium= Intrinsic Value + Time Value

100 = 70 + Time Value

Time Value = 30.

Now, let’s assume that the market moved sideways and opened at the same value the next day, the time value in the above case will decline leading to a decrease in the option value.

Let’s now understand the reasons why option buyers lose money and the ways to minimize those losses:

1. Theta

As discussed above, time value is the depreciating factor in options trading. Now this time decay in options can be determined with the help of Option Greek THETA.

It is the rate of change in value to your option’s premium as it reaches the expiration date. Now this value depends on two major factors:

- Time left to expiry

- Strike Price

The less time you have before the expiry the more will the theta and hence premium loses its value faster from those options having far expiry.

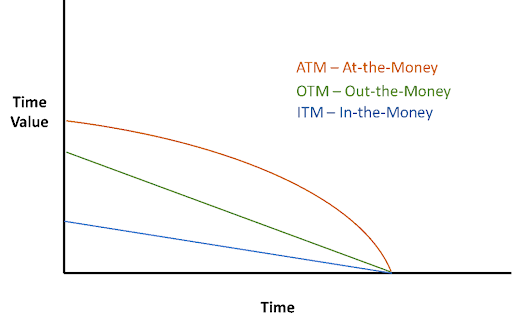

On the other hand, ATM options have the highest theta value and decline faster near expiry in comparison to ITM and OTM options.

To understand this change and value you need to learn how to read and understand what does option chain indicate. All these values, further helps you in determining the risk-reward and other important parameters that helps you to learn how to do option trading.

2. IV in Option Chain

Implied volatility is a critical factor that affects options pricing and can lead to losses for option traders. It represents the uncertainty associated with the future price movement of the underlying asset.

This is impacted by any news, events, or announcements and can be determined with the help of Option Greek, Vega.

When volatility is high, options premium increase because there is a higher probability of the underlying asset moving significantly in price. Conversely, when volatility is low, options prices decrease because there is less chance of the underlying asset making significant moves in price.

In general high implied volatility leads to an increase in Last Traded Price, i.e. LTP in Options, however, if it decreases then it leads to a major loss for the option buyer.

The more days to expiry, the more the impact of change in the implied volatility of the options, hence the higher the risk to lose money.

3. Delta

Another important parameter that can lead to losses in option buying is the high delta value. Beginner option buyers generally trade In the Money options as there is a high possibility of these contracts expiring in the money. However, these options have high delta values.

This means the change in the value of underlying assets moves brings more change in option value. For example, the ITM option has a delta value in the range of 1-0.5. Let’s say you buy Nifty 18000 CE when the market is trading at 18200 at ₹280. The corresponding delta value is 0.8.

This means with the change in the value of the underlying asset by 100 the value of the premium rise or falls by ₹80.

If the value of the underlying asset, i.e. Nifty dropped to 18100, i.e. by 50 then the premium intrinsic value will drop by ₹40, hence the new premium value would be ₹240.

Apart from this, the reason of traders losing money is because they consider options trading gambling and trade without complete knowledge and skills. However, you can reduce your risks and losses by taking stock market classes and courses

How to Avoid Losses in Options Trading?

Now on the basis of the above data, it is important for an option buyer to buy contracts that have the least risk. For this, it is important to choose:

1. Choose Options with Far Expiry: This reduces the impact of theta and brings in an opportunity for the option buyer to minimize the losses in case the market does not move in its predicted direction.

2. Stay Away from High Volatile Options: Although the increase in implied volatility increases the premium value, but a sudden drop in the IV value can lead to a drop in the premium thus leading to heavy loss.

3. Avoid Buying Deep Options: Buying deep ITM and OTM lead to losses. On one hand, where deep ITM is costly and has a high delta value, deep OTM has the least chance to expire in the money, and thus the chances to lose the whole premium increase.

4. Avoid Overnight Holding in Option Buying: Since theta reduces the premium value with each passing day, hence it is recommended to do intraday in option buying to avoid losses in the volatile or unpredictable market conditions.

Conclusion

Options buying requires a lot of skill, market analysis, and patience too. It is very important to understand the risks of buying options. You must take a cautious and informed approach to investing in options.

For this, you can refer to some of the best books on option trading.

There are a lot more ways to avoid losses in options trading that require a deep understanding of the process. We at Stock Pathshala help new traders to get a better way to learn options trading.

In case you’d like us to call you back to explain more about stock market learning, just leave your contact info below:

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: