Right from childhood, you come across the fact, ‘Time is Money’ and which is true as well. Each minute of our day counts and if used efficiently helps in adding value. This fact is best illustrated in options trading. The value of the option premium decreases with each passing day. In simple terms, there is a time decay in options that resulted in the decreasing value of options contracts.

Time decay is the magic wand that helps option sellers gain profit in most market conditions. In this article, we will understand what is the time decay in options.

What is Time Decay in Options Trading?

Each option contract has the premium value that is paid by the option buyer to the seller to get the right but not the obligation to settle the trade. Now, this premium consists of Intrinsic value and Time value. Intrinsic value is the difference between spot and strike price if the option expires In the Money, on the other hand, the time value is the extra premium asked by the seller on the basis of the time left for expiry.

For example,

Let’s consider a scenario where Nifty is trading at 18000.

Trader A is bullish on the market and thus bought one lot of Nifty 17800 CE for ₹250. The days left to expiry are 4 days. Understanding the theoretical meaning of this, trader A got the right to settle the trader on expiry if the market expires above 17800.

But looking at the current market value, it is already above 200 points. This difference between the spot price and the strike price is the intrinsic value of options.

Now why the seller is asking for ₹250 premium when the intrinsic value is 200?

Well, this is because of the 4 days which are still left for expiry and the possibility of the market value expiring above 18000, i.e. current market price.

The additional ₹50 is the time value. With each passing day, less time will remain to expiry, and hence time value of the premium decreases.

This is a depreciating factor that resulted in the reduction of the option premium value. It is based on the assumption that all the other variables, like stock price, interest rates, and IV in option chain, remain constant.

So, if the market moves sideways then the time value of ₹50 will decline by a certain value.

But by what value, time value declines in the premium?

To calculate this, there is an Option Greeks, Theta.

What is Theta in Options?

As discussed above, Time decay depicts the depreciating value of option premium which is calculated using option Greek ‘Theta’. It represents the rate at which the option loses its value. This value is represented by a negative number in the option chain as it works against the option buyer (one who is paying a premium in the market).

Now where to find this value?

Well, this is what the option chain indicates.

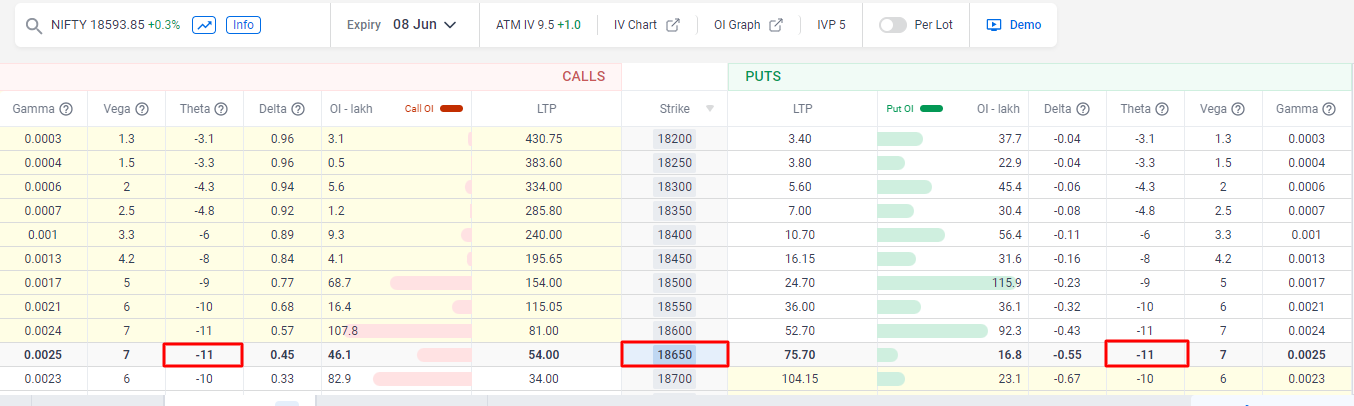

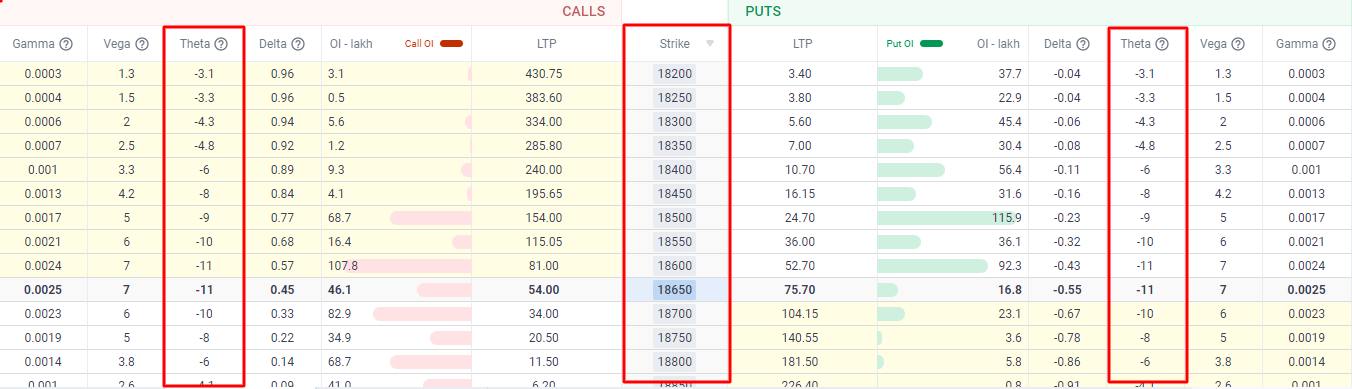

In an advanced option chain, as shown below, you can see all the Options Greek, Theta, Delta, Gamma, and Vega.

Looking at the ATM option, the theta is equal to -11. This means that with each passing day, the value of your option will decrease by ₹11. It is important to note that the time value of an option decreases even if the stock price hasn’t changed. In other words, it is like losing an asset as your option reaches its expiration date.

Also, looking at the theta value of different strike prices, there is a difference across different options contracts.

Analyzing this difference, it is concluded that options near ATMs have high theta values in comparison to deep ITM and OTM respectively. This means that the option premium depreciates at a slower rate for the deep options contracts.

Now, let’s analyze these differences with respect to expiry. Does the time value have any relation with the expiry as well?

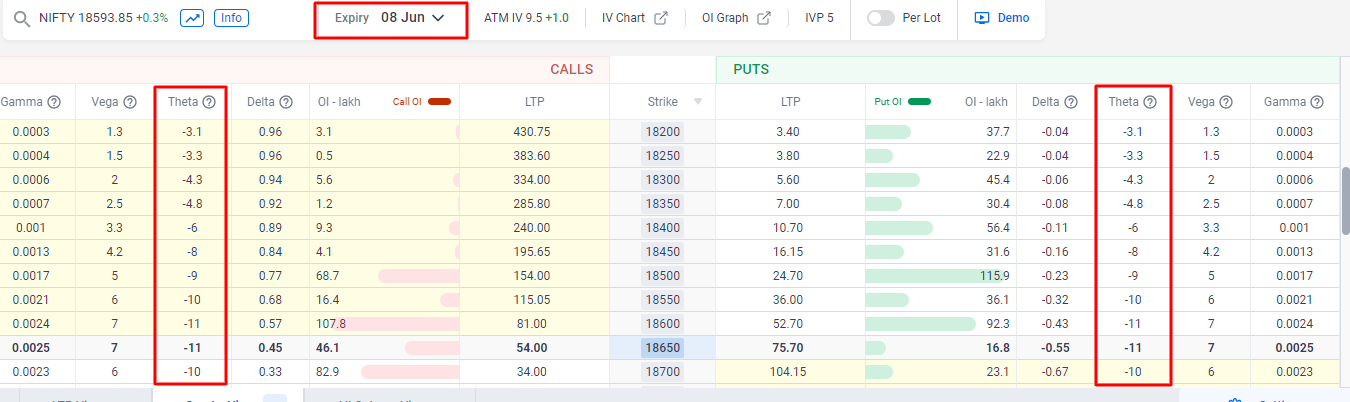

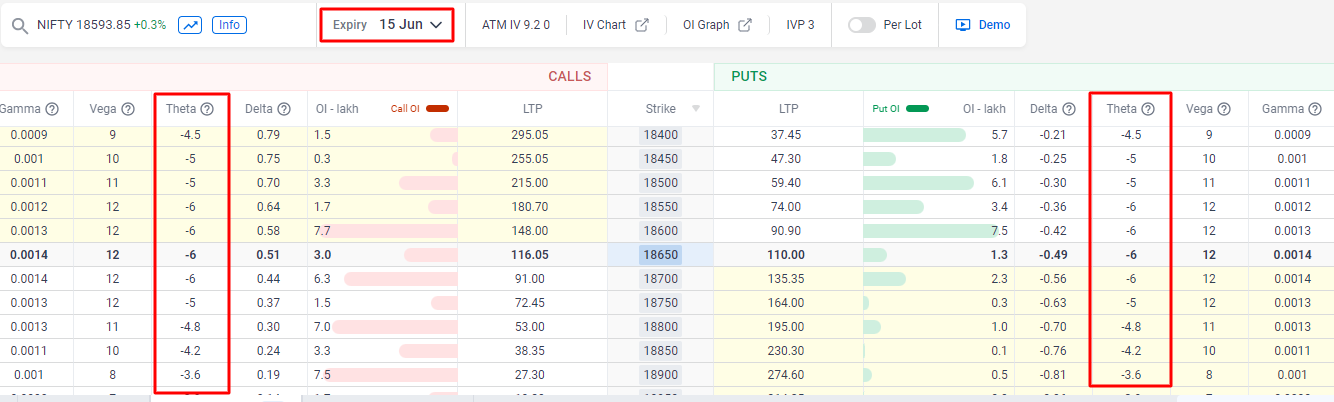

To understand this, here are two different expiry dates and the corresponding theta value:

The nearest expiry is of June 8 where the theta value for ATM option i.e. Nifty 18650 is -11 for both call and put options. On the other hand, looking at the theta for the far expiry of 15th June, the theta value is -6 for ATM options.

This means, that the theta value increases near expiry and hence option loses its value as the expiry date approaches.

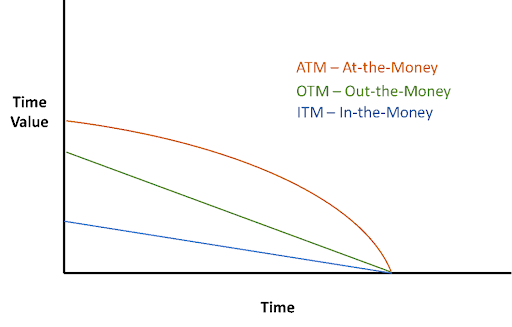

Last but not the least, here is the trend of theta decay with respect to the expiry date.

Here the red line depicts the rate of theta decay of ATM options, while green and blue are the rate of change of theta for OTM and ITM options with respect to expiry, respectively. It is clear from the above graph that the ATM option loses its value faster than OTM and ITM options as the option approaches its expiry.

After getting an understanding of theta, learn how option selling works and maximize your profit in options trading.

Why Option Buyers Lose Money?

On the basis of the above data and understanding, it is clear that it is the option seller who gets benefitted from the time decay in options. Since the option seller makes money hence it is the buyer who loses money in the market by some amount, even though the market works in their favor.

In such cases, holding an option overnight could be riskier for the buyer than the seller. To avoid this loss option buyers generally choose 5-min or 15-min option trading time frames and trade in intraday.

Also, some of the options opt for the far expiry option like monthly expiry rather than weekly expiry as it holds comparatively less theta value. Also, to neutralize or reduce the impact of time value in options, the buyer can opt for certain strategies like Bull Call or Bear Put strategy.

Conclusion

Time decay is a crucial factor in options trading. Although it can be used by both buyers and sellers, it typically favors the option seller.

So, if you are a beginner who is learning how to do option trading, it is important to consider the role of the time value in options as it helps in the potential loss for the option buyer and the profit in option trading for the seller in the range market.

In case you’d like us to call you back to explain more about stock market learning, just leave your contact info below:

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: