The share price keeps moving every second and minute during the trading session. There are four different price values associated with any share or index also called OHLC (opening, high, low, and close prices) that are determined with the candlestick. But along with these values, there is one more price associated with the share, called Last Traded Price. It sounds similar to the closing price, Right? But it is different from the one. In this article, let’s discuss what is LTP in the share market and its significance in share trading.

LTP in Share Market Meaning

To explain the meaning of LTP, let’s consider one example.

Suppose you went to a local market to buy one shirt. The MRP on the shirt was ₹999. Let’s assume this to be the opening value. Now the seller negotiated a bit and closed it for ₹950. However, you ask for more discount and the final transaction was done at ₹920.

In the above example, ₹920 is the LTP of the shirt.

Thus, LTP in the share market is the value at which the transaction of a particular stock is done. It shows the equilibrium between buyers and sellers at a specific point in time. LTP keeps on changing throughout the day because it is measured in real-time.

It helps buyers and sellers to discover the relevant prices of the stocks and in determining the price movement.

What is LTP in Options?

Options trading is buying and selling of the contract where the buyer pays a premium value to the seller and gains the right but not obligation to execute the trade at the predetermined price on expiry. Here the premium amount at which both buyer and seller agree to enter the trade is called Last Traded Price or LTP in Options.

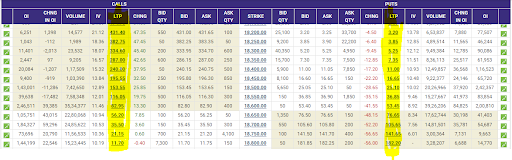

The careful study and understanding of LTP in options trading and its analysis along with volume and other data in the option chain helps in determining the market trend and traders’ activity in the market.

The highlighted column in the option chain below is the LTP data of both call and put options. Now let’s understand what does option chain indicate with this LTP data.

What is LTP in the Future Trading?

Similar to shares, the buyers and sellers place their bids and ask for value for the future contract to buy and sell underlying assets in the future. Here the value at which the trade is executed by the exchange is called LTP in Futures.

It depends upon the liquidity of the futures contract, i.e. the demand and supply of the underlying asset in the existing market condition.

How LTP in Share Market is Calculated?

Now LTP in the share market cannot be determined manually and can be checked at the NSE and BSE websites. Similarly for options, the LTP can be checked in the option chain. Also, in options trading this LTP value helps the trader in determining the intrinsic value and time value associated with the particular contract value.

For example, let’s consider the current market value of Nifty to be 18000.

Now let’s pick 3 different strike prices for the call option and the corresponding LTP value.

LTP in Options Trading Strike Price Premium Intrinsic Value Time Value 17800 CE ₹310 200 110 18000 CE ₹90 0 90 18200 CE ₹75 0 75

In the table above, the strike price of 17800 has an intrinsic value along with the time value and hence are ITM call option. The other two option contracts are ATM and OTM options with no intrinsic value. This gives the buyer a choice to use its capital wisely and to determine the risk and reward associated with trading in a particular option contract.

What is the Change in LTP in Share Market?

However, one cannot determine the change in LTP by any manual calculation or formula but can check the change in its value on NSE and BSE websites. Similarly, changes in the premium value in options trading can be checked in the option chain.

Here the question is, how this change in LTP helps a trader in determining the potential market trends or other related information?

Determining the change in LTP value alone does not provide much information to the trader, however, when compared with other data like volume help in finding the market trend.

The volume is the number of underlying shares traded at a specific price. When the volume is high, this implies there are both buyers and sellers in high numbers, which brings liquidity to the market.

On the other side of the mirror, if trade volume is low, there are fewer buyers and sellers. This makes price discovery difficult because it shows a wide difference between the bid and ask.

Low trade volume has a huge impact on the last traded price. Now analyzing this data of change in volume and LTP with respect to each other helps in determining the market trend.

For example, if the change in LTP is positive and is accompanied by positive volume, it indicates a bullish market. Similarly, one can determine the trend by using the information provided in the table below:

Change in Volume in Relation to Price Volume Change in LTP Trend Increases Positive Bullish Increases Negative Bearish Decreases Positive End of Bullish Trend Decreases Negative End of Bearish Trend

What is Change in LTP in Options?

Apart from the change in volume with respect to the change in Last Traded Price, options traders also use this data to determine the impact of change in OI. In general OI data gives detail of PCR in option chain but the change in its value also helps in determining the aggressiveness of the traders.

An increase in OI accompanied by an increase or positive change in LTP depicts Long Buildup i.e. buyers are more aggressive to open position at a corresponding strike price.

Similarly, there are different analysis which is summarized in the table below:

Change in Open Interest in Relation to LTP OI Value Change in LTP Trade Position Increases Positive Long Buildups Increases Negative Short Buildup Decreases Positive Short Covering Decreases Negative Long Unwinding

No doubt the aggressiveness and volume change the premium value, but along with this IV in option chain has a huge impact on the ltp in the option. The higher the IV more will be the premium and vice versa.

You can analyze this change in ltp with the help of vega in options that measures the sensitivity of premium with implied volatility.

What is the Importance of LTP in the Share Market?

Getting LTP data does not provide much information to traders, however, the change in LTP along with other available data like change in volume and open interest provides useful information related to trend and active positions in the market.

1. You can use LTP in price discovery and fair value calculations.

If you compare the LTPs of the stock and options, this can help you in certain price movement predictions and fair calculations.

2. It also helps in executing trades at normal prices

Placing limit orders near LTP can help you trade wisely and monitor the market more closely.

3. LTP lets you analyze option chain imbalances

Option chain imbalance happens when there is a huge difference between the LTPs of call and put at the same strike price. You can figure out these imbalances and make profitable strategies.

Conclusion

The last traded price is only relevant during that day’s trading session. When the session ends, LTP is converted to the closing price, but we should keep in mind that the closing price and LTP are different and should not be interchanged.

In addition to LTP, you should know what does option chain indicate. We at Stock Patshala provide detailed learning of all major stock market concepts and make the journey easier. You can enrol in our stock market courses and get mentored by experienced tutors.

In case you’d like us to call you back to explain more about stock market learning, just leave your contact info below:

Before investing capital, invest your time in learning Stock Market.

Fill in the basic details below and a callback will be arranged for more information: